Deutsche Bank was fined $150 million on Tuesday by the New York regulators for “mistakes and sloppiness” on the account of sex-trafficker Jeffrey Epstein ties.

Due to “significant compliance failures” Epstein was able to conduct hundreds of transactions totaling millions of dollars. This is not the first penalty charged to Deutsche Bank as previous is was involved in the scandal of Danske Bank Estonia. However, this is the first action taken in relations to Epstein dealings.

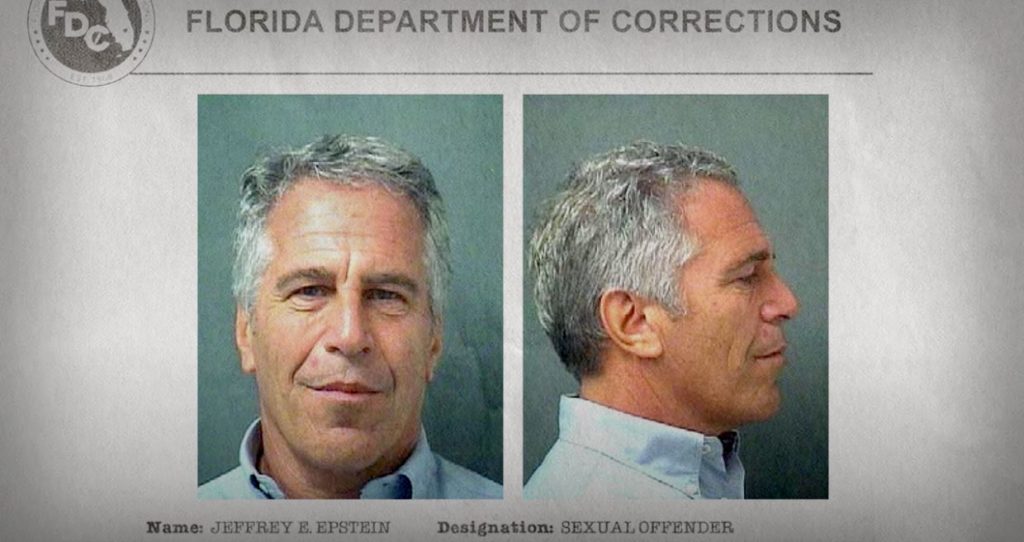

Epstein committed suicide in August 2019 while awaiting trial on federal charges accusing him of operating sex-trafficking ring, which involved girls as young as 14 at his Palm Beach estate and Manhattan mansion. Deutsche Bank failed to detect “Many subsequent suspicious transactions” said New York State Department of Financial Services.

Suspicious transactions flagged by the regulator included payments to individuals who were alleged to have been co-conspirators Epstein in sexually abusing young women, as well as payments to Russian models, school tuition’s for several women, hotel expenses and direct payments to numerous Eastern European women.

Deutsche Bank, Germany’s largest bank has a history of legal problems in the United States. It consistently failed to properly monitor account activities of the registered sex offender “despite ample information that was publicly available” linked to his earlier criminal misconduct.

After Epstein’s arrest, Deutsche Bank acknowledged its “error of on-boarding Epstein in 2013 and the weaknesses in our processes and have learnt from our mistakes and shortcomings.” The Bank has invested nearly $1 billion in training, controls and operational processes and has hired more than 1,500 people to its financial crime team.

“Our reputation is our most valuable asset and we deeply regret our association with Epstein” the bank said. DFS credited Deutsche Bank’s “exemplary cooperation” with the investigation.

In 2006, Epstein faced federal investigation regarding accusations he preyed on and sexually abused underage girls. He ended up signing a non-prosecution deal with federal prosecutors in Miami the following year which allowed him to plead guilty to two state prostitution charges and serve just 13 months in a Florida State prison.

“Despite knowing Mr. Epstein’s terrible criminal history, the bank failed to detect or prevent millions of dollars of suspicious transactions.” Linda Lacewell, superintendent of New York State DFS. The Bank was repeatedly made aware of the registered sex offender’s past accusation and his alleged accomplices as soon as he became a client.

The regulator mentions that in April 2013, a junior account executive flagged Epstein’s plea deal and prison sentence to the senior bank executives in a memorandum. Another account executive working on the account sent a memo note to the senior executives stating, “how lucrative the relationship could be”.

From 2014 through 2015 the Bank’s anti-financial crime department identified several red flags, some regarding his relationships with a prominent former US politician and a member of a European royal family.

Two bank executives agreed to explore the issues and met Epstein at his New York home, where one of the executives asked him “about the veracity of the recent allegations and appeared to be satisfied by Mr. Epstein’s response” DFS says. A week later at the bank executives meeting, there were no recorded minutes from the meeting with Epstein. Later same day, according to the order, one of the executives emailed another to say the committee was “comfortable with things continuing” with Epstein.

As mentioned earlier, Deutsche Bank has a long history of regulatory troubles. In 2017, it was hit with a $630 million in penalty over a $10 billion Russian money laundering scandal.

In late 2016, the Bank reached $7.2 billion settlement with the US Justice Department regarding toxic mortgage assets, which came a year after it had agreed to pay $2.5 billion in penalties over interest rate manipulation.

Lastly, Deutsche Bank has had a long and complicated relationship with USA’s current President Donald Trump. The Bank has lent over $2 billion over the past two decades and at the time of his election, the Bank was the largest lender to him, according to The New York Times.